Selling a car can be something that excites you. It doesn’t matter if you are buying a new one or parting ways with the old one. While it can be exciting, it is important for you to complete the important paperwork and legal requirements, especially when it comes to telling the Driver and Vehicle Licensing Agency or DVLA in the United States that you have sold your car. Informing this agency about the sale is a must unless you want to face something complicated, get fined, or get unexpected liabilities.

For anyone who has sold your car and wants to avoid facing complicated things and getting fined by telling the DVLA about the sale, you are on the right page as you will be guided about it here.

Best Time to Tell the DVLA that You’ve Sold Your Car

The best time to tell the Driver and Vehicle Licensing Agency or DVLA that you have sold your car is after you hand over the keys of the car to the new owner. Make sure to do it as soon as possible because it can minimize the risk of you being held accountable for any offenses that they may commit and anything they must pay.

Methods to Tell the DVLA You’ve Sold Your Car

There are several ways to tell the Driver and Vehicle Licensing Agency or DVLA that you have sold your car. Make sure to read everything clearly.

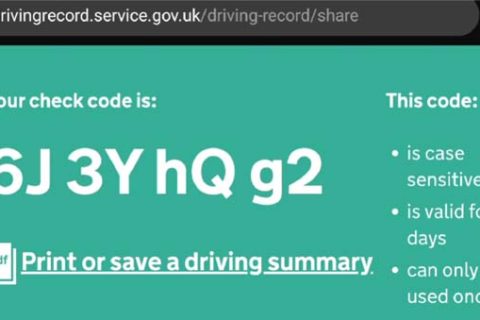

The first way to notify the DVLA that you have sold a car is to use its dedicated online service. It is known as the best and the easiest way. If you want to do it online, the first thing that you need to do is to go to the official website of the Driver and Vehicle Licensing Agency or DVLA at https://www.gov.uk/sold-bought-vehicle. When you are there, you will be asked whether you are a motor dealer or not. In case you are not familiar with a motor dealer, it refers to a motor dealer, a motor auctioneer, a salvage dealer, a finance or insurance company, a fleet operator, or a car buying service.

Read also: How to Contact DVLA Cosutumer Service

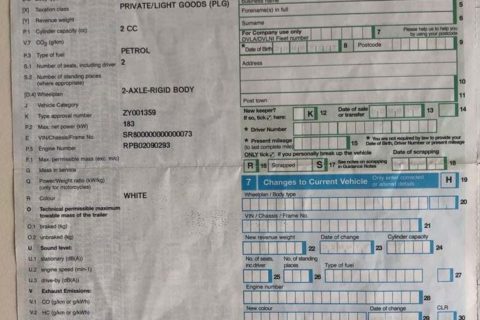

If you are a motor dealer, you will be asked whether you have bought or sold a vehicle. If you bought a vehicle into the trade, you must make sure that the name and address on the log book (V5C) are correct and any personalized registration numbers have been kept or transferred. There are two things that you will need, including the 11 digit reference number from the latest log book and the consent of the seller to act on their behalf.

When you have completed the service, remember to destroy the yellow ‘sell, transfer or part-exchange your vehicle to the motor trade’ section from the log book. It means there is no need for you to send it to DVLA. After that, the registered keeper of the vehicle will be removed from DVLA records. The confirmation will be sent by post. It is said that the registered keeper will automatically get a refund cheque for any full months left on their vehicle tax. Talking about the refund, it will be calculated from the date DVLA gets the information.

In case you fail to use the online service, please fill in the yellow ‘sell, transfer or part-exchange’ section with your trader details. The section should be sent to DVLA at:

| DVLA Swansea SA99 1BD |

If you sold a vehicle out of trade, you also need the 11 digit reference number found on the latest vehicle log book (V5C). Besides, you should also do the following instructions:

- Hand over the green ‘new keeper’ slip from the log book to the buyer.

- Notify the DVLA that you have sold the vehicle using this service.

- Get rid of the rest of the log book.

There is no way for you to use this service if the buyer is registering the vehicle aboard, including the Channel Islands (Jersey and Guernsey), Isle of Man and Ireland. If it is the case, please fill the ‘permanent export’ section instead. If you want, you are allowed to take the registration number off the vehicle. It should be done before you tell DVLA you sold your vehicle.

Before the buyer drives the vehicle, they must tax it. Another option is to declare that it’s off the road. Apparently, the tax is not transferred when the vehicle is sold. After doing so, they should get an email confirmation (if you have their email address) and a new log book within 5 working days.

Actually, it is not the only way to tell the DVLA if you have sold your car out of trade. An alternative way is to fill in the log book and post it to DVLA at:

| DVLA Swansea SA99 1BA |

If you are not a motor trader, you will be asked what you have done with your vehicle. The options include “Sold it”, “Put it into someone else’s name, including transferring it to a family member or friend”, “Scrapped it or it’s been written off”, and “Bought it”.

If you sold it, you will be asked whether you sold the vehicle privately or to a motor trader. If you sold it to a motor trader, you need the 11 digit reference number from the latest vehicle log book (V5C). Then, do the following steps:

- Hand over the log book to the buyer, including the green ‘new keeper’ slip.

- Notify DVLA that you have sold the vehicle using this service.

- Get rid of the yellow ‘sell, transfer or part-exchange your vehicle to the motor trade’ section from the log book.

If you want to keep the registration number, it is possible for you to take it off of the vehicle. Please do it before you tell DVLA you sold your vehicle. After that, you will get an email confirmation (if you gave your email address), a letter that confirms that you are no longer the keeper of the vehicle, and a refund cheque for any full months left on your vehicle tax. For the latter, it is calculated from the date DVLA gets your information. For anyone who pays by Direct Debit, it will be cancelled automatically.

If you don’t feel like doing it online, there is another way for you to tell DVLA you have sold your car. If there is a log book, it is a must for you to get the motor trader to fill in the yellow ‘sell, transfer or part-exchange’ section. After they fill it, send it to DVLA. On the other hand, if there is no log book, please write to DVLA by including your name and address, the registration number of your vehicle, the make and model of your vehicle, the exact date of sale, and the name and address of the new keeper. Make sure to include all the information unless you want your notification to be rejected which can affect any vehicle tax refund you are owed. Do not forget to send post it to the following address:

| DVLA Swansea SA99 1BD |

If the vehicle was sold privately to a person or business, you need the 11 digit reference number from the latest vehicle log book (V5C). Apart from that, you should also do a few things such as:

- Hand over the green ‘new keeper’ slip from the log book to the buyer.

- Notify DVLA that you have sold the vehicle using this service.

- Get rid of the rest of the log book.

Once again, it is worth noting that there is no way for you to use this service if the buyer is registering the vehicle abroad. The thing that you have to do is to fill in the ‘permanent export’ section.

Afterward, you will be sent three things, including an email confirmation (if your email address was given), a letter that confirms that you are no longer the keeper of the vehicle, and a refund cheque for any full months left on your vehicle tax. As for the new owner, they will get an email confirmation (if you gave their email address) and a new log book within 5 working days.

Besides, it is also possible for you to notify DVLA that you have sold your car by filling in the log book and post it to DVLA at:

| DVLA Swansea SA99 1BA |

For anyone who does not have a log book, please include your name and address, the registration number of your vehicle, the make and model of your vehicle, the exact date of sale, and the name and address of the new owner.

If you put your vehicle into someone else’s name, you need the 11 digit reference number that you can get from the latest vehicle log book (V5C). Not only that but also hand over the green ‘new keeper’ slip from the log book to the new keeper, notify DVLA that you have put the vehicle in someone else’s name using this service, and get rid of the rest of the log book. Apparently, the name of the new owner can be used as the one you have sold the car to. Do it even if you did not charge them any money for it.

In the end, you will be able to get an email confirmation, a letter that confirms that you are no longer the keeper of the vehicle, and a refund cheque for any full months left on your vehicle tax. Meanwhile, the new keeper will get an email confirmation and a new log book within 5 working days.

Just like before, it is also possible to fill in the log book and post it to DVLA at:

| DVLA Swansea SA99 1BA |

In order to do it, include several things such as your name and address, the registration number of the vehicle, the make and model of the vehicle, the exact date of sale, and the name and address of the new keeper.

If you scrapped your vehicle or it has been written off, you also need the 11 digit reference number from the latest vehicle log book (V5C) and do a few things such as notifying the agency that you have scrapped or written off the vehicle using this service and getting rid of the log book except if you have already handed it to the vehicle scrapyard or insurance company. For your information, the name of the vehicle scrapyard or insurance company can be used as the trader you’ve sold the vehicle to. It is possible to do it even if you did not get any money for it. In the end, you will get an email confirmation, a letter with confirmation that you are no longer the keeper of the vehicle, and a refund cheque for any full months left on your vehicle tax.

If you want to do another method, you can ask the scrapyard or insurance company to fill in the yellow ‘sell, transfer or part-exchange your vehicle to the motor trade’ section and send the perforated section to DVLA at:

| DVLA Swansea SA99 1BD |

In case the log book is nowhere to be found, include your name and address, the registration number of the vehicle, the make and model or the vehicle, the exact date of sale, and the name and address of the scrapyard or insurance company when writing to the agency.

If you bought a vehicle, it is a must for you to tax the vehicle to be able to drive it. Besides, you can also declare that it is off the road. Take a note that you should also get the green new keeper slip from the seller to be able to tax the vehicle. Aside from that, they also have to post the log book (V5C) to DVLA or tell DVLA online you are the new keeper. In case a new log book is not in your hand within 6 weeks, just register your vehicle yourself.

If the log book is given, make sure to fill in section 2 with your name and address if you have a new style log book and section 6 if you have the older style log book. After filling these two, send it to DVLA at:

| DVLA Swansea SA991BA |

What if you don’t have a UK address? In case you don’t have a UK address, you should get the whole log book or V5C) from the seller so that you will be able to register the vehicle in another country.

Bottom Line

For many, selling a car is something that is important. In fact, telling the Driver and Vehicle Licensing Agency or DVLA about the sale is part of the process. That’s why it is also important. By following the guide to notify DVLA about the sale explained in this post and making sure that all paperwork is completed, the potential complications and legal issues related to the sale of your car can be avoided.

A bookworm and researcher especially related to law and citizenship education. I spend time every day in front of the internet and the campus library.