Everyone wants to live in a state that has a low tax bill. One way for Americans to reduce their tax burden is by moving to an income tax-free state. Currently, there are several states that have no state income tax, including Alaska, Nevada, South Dakota, Texas, and Wyoming. By the way, is Florida one of the states that doesn’t have a state income tax?

According to research, Florida is one of the most desirable states for retirees and refugees from other states. In fact, the number of people moving to Florida is at a record high. Migrants move to the Sunshine State for several factors such as its beautiful beaches, cultural diversity, and business-friendly environment. However, the main reason why people are moving to Florida is because of the state’s low tax burden.

Read also: How to Find Out Where’s My IRS Refund

Does Florida Have a State Income Tax?

Now you might be curious about whether Florida has a state income tax or not. For your information, Florida does not have a state income tax. Since there is no state income tax, Florida is known as one of the lowest-taxed states in the United States.

The state government funds its operations through sales taxes, fees, and revenue from the federal government’s revenue from the federal government. While Florida does not have a state income tax, it does impose a levy on corporate profits. Therefore, if you own a company in Florida, you still must pay taxes on your business to the state government. Sales and use tax, corporate income tax and intangible tax are the main taxes levied in Florida.

You should know that Florida does not have a state property tax either. Only local governments levy property taxes, which make up a large portion of local budgets. Although there is no statewide property tax, you should still consider these city fees when calculating the tax burden you will face in the state.

How Does Florida Not Have a State Income Tax?

According to the sources we got, in 1968, the Florida constitution was passed to prevent the state from levying a state income tax. It protected taxpayers from the state imposing new taxes or raising taxes. Then, in 2018, Florida voters approved a constitutional amendment that requires the state House of Representatives and the state senate to increase any state taxes or fees.

Government spending per capita in the state is among the lowest. The number of state employees per capita in the state is also less compared to other states. This limited government expenditure has certainly helped the state maintain a budget that does not require additional revenue derived from the state income tax. If the state has an income tax, it is likely that other taxes will not be sufficient. While Florida does not have a state income tax, they do have revenue from fees and other taxes. Perhaps this is one of Florida’s ways to appeal to Corporate or high-income residents. By not having a state income tax, Florida is able to attract many people and companies. Therefore, Florida is said to be the most desirable state for many people, especially retirees. If the state implements an income tax, then there is a possibility of the state losing revenue because it is no longer attractive to companies, high-income residents, or certain job seekers who contribute to the state through property tax and sales tax.

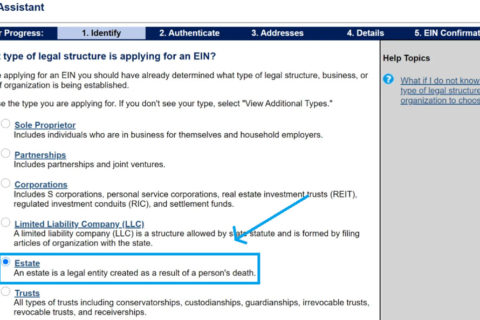

That is why retirees from other states are attracted to Florida. Florida has no state income tax at all, so the number of people moving to Florida is at a record high. None of their pensions, 401(k)s or IRAs are taxed, making them more palatable to a demographic that typically lives on a fixed and stable income. In addition, in 2004, Florida also abolished the inheritance tax, estate tax, and gift tax. For your information, the estate tax and inheritance tax are usually levied when someone receives property or inheritance from a recently deceased person. Meanwhile, a gift tax is a tax levied when a person bequeaths property or money to another living person. With Florida not enforcing these tax rules, it is a great advantage for beneficiaries and families who want to build generational wealth.

As we already explained that one of the main taxes levied in the state of Florida is the corporate income tax. For businesses that are established in the state of Florida or that make money in the state of Florida, the owners of the Company will be levied a corporate income tax of 5.5%. Due to the 2018 tax cuts and business-friendly environment, the state has generated more economic activity, which in turn has generated more tax revenue from other tax sources such as sales and use tax, corporate income tax, and intangible tax.

Florida Sales and Excise Taxes

While Florida does not have a state income tax, it makes up for the shortfall with other taxes, such as sales tax. According to research, Florida sales and excise taxes generate about 80% of the state’s revenue. These sales taxes are levied on goods and services. States and counties have their own percentages. You should know that the state sales tax rate is 6%, whereas, the county sales tax rate is only 1.5%, bringing Florida’s total sales tax to 7.5%.

The prominence of the tourism industry in Florida is one of the reasons Florida’s sales and excise taxes more than make up for the lack of state income tax. As we know, Florida is also one of the tourist destination states. There are many tourist attractions, hotels, and restaurants that attract many people. Those attractions, hotels, and restaurants can generate revenue for the state. Although Florida has a sales tax that is their revenue, there are some items that are not subject to sales tax. Some types of products that get a sales tax exemption are prescription drugs, groceries, and fertilizers.

Additional excise taxes on certain goods and services can also make up for shortfalls in state income taxes. Florida can receive a significant amount of excise tax from the fuel tax, which consists of an excise tax and an additional tax, depending on the type of fuel used. The fuel tax rate is about 43.6 cents per gallon. This is certainly one of the state’s sizable revenues considering how vast the State is, roughly taking about 10 hours to drive from the southernmost point in Key West to the capital city of Tallahassee. In addition to fuel excise taxes, Florida also levies excise taxes on alcohol and tobacco products. It should be noted that excise taxes are like sales taxes. However, excise taxes are not levied when consumers purchase products or services, but rather they are levied when manufacturers sell them to retailers.

Florida Property Tax

As we said in the previous paragraph, Florida does not have property taxes. In Florida, only local governments have property taxes, and they make up the bulk of local budgets. For homeowners, the average annual property tax rate is 0.86%. This makes Florida the state that has the 25th lowest property tax rate in the United States. This equates to about $1,759 per year. As for the national average home property tax rate, it is about 0.97%.

To reduce the burden on residents, Florida offers several exemptions, including the homestead property exemption, which includes the following exceptions:

-

- Any individual who has a permanent residence for themselves is eligible to receive an exemption of $50,000.

- Widowers or widows are eligible to receive the exemptions of $500.

- Any totally blind and disabled individual with a gross income below the threshold can receive a full exemption.

- Spouses of deceased civil servants can get a full exemption.

- Disabled veterans with a disability of 10% or more can receive a $5,000 exemption.

- Senior citizens of Florida who are 65 years old and above with a permanent or partial disability are eligible to receive a discount on the property they own.

Other Taxes and Fees in Florida

To generate revenue, Florida applies other types of taxes and fees, such as insurance taxes charged on various processes. Insurance premiums are a fairly high tax in Florida. This tax levies 1.75% on the gross amount of insurance premium receipts. Another tax in Florida is the documentary stamp tax. Examples of the documentary stamp tax are real estate mortgages, loans, and transfer deeds. In Florida, all counties levy a tax rate of 0.7% for every $100 spent. Whereas, Miami-Dade charges 0.6% for every $100 spent. In addition, Florida also has income from other fee charges, such as toll fees for toll roads, car registration fees, and special license plate fees. Despite the various taxes and other fees, the state is still known as a low-tax state.

A bookworm and researcher especially related to law and citizenship education. I spend time every day in front of the internet and the campus library.