The US government provides relief money to US citizens from Stimulus Check. At this time, US citizens are waiting for the 4th Stimulus Check 2024. This 4th Stimulus Check will be issued to a total of 9 out of 20 US states. The amount of the 4th Stimulus Check will vary. If you are a US citizen, and want to get the relief money, then you must check the Stimulus Check Eligibility which is based on the Adjusted Gross Income (AGI). Now the question is, when will the 4th Stimulus Check arrive? Read this entire article to find out the information.

What is the IRS Tax Stimulus Check?

A Stimulus check is a payment from the federal Government to eligible US citizens with the aim to offer financial assistance and stimulate the American economy. The Internal Revenue Service (IRS) officials have already issued three stimulus checks. Now, eligible US citizens are waiting for the 4th Stimulus Checks 2024. For your information, stimulus payments can be made through several ways. The main purpose of Stimulus Check payments is to help US citizens who are likely to face economic uncertainties, challenges, or emergencies. Eligible US citizens can use the stimulus checks as they want. The Stimulus Check payment amount is sent directly to the taxpayer’s account. In essence, these Stimulus Checks are meant to encourage spending, improve the economy, and ease financial problems for those affected by different economic situations.

Expected Date for the 4th Stimulus Check

US citizens are waiting for the 4th Stimulus Check payment. But the 4th Stimulus Check payment will be made to US citizens has not been disclosed by the Internal Revenue Service (IRS). As of now, the exact date has not been announced. In this case, your state will also determine when the 4th stimulus check payment is released. For your information, in some states, the 4th Stimulus Checks have already started arriving in mailboxes. We have been informed that the 4th Stimulus Check is expected to be sent in October 2024. Once again, we remind you that the stimulus check payment will vary from state to state. In the next few weeks, it is likely that US citizens who meet the Adjusted Gross Income (AGI) requirements will receive payments. All states will make announcements about the dates they plan to issue the 4th Stimulus Check payments in a public forum. Therefore, make sure you don’t miss out on this information. Keep an eye out for public announcements on public forums according to your state.

Amount of the 4th Stimulus Check 2024

If you are a taxpayer in the US and eligible for a stimulus check payment, you surely want to know how much the 4th Stimulus Check payment is. For your information, the 4th stimulus payment will range from $200 to $1,700. Approved by Congress, the American Rescue Plan is the basis for this. Families in the United States with at least four members will receive $3,400. The program provides $1,400 stimulus payments for US citizens earning up to $75,000 per year or $150,000 for US citizens applying jointly as a married couple. Then, for US citizens earning more than $75,000 per year, the amount of the stimulus check will be reduced. For US citizens earning more than $99,000 per year, they will not get financial assistance due to ineligibility.

Eligible Individuals for the 4th Stimulus Check Payment

According to the Internal Revenue Service (IRS), the following people are eligible to get stimulus check payments:

-

- Individuals who have an Adjusted Gross Income (AGI) of up to $75,000.

- A married couple applying jointly with an Adjusted Gross Income (AGI) of up to $150,000

- Guardian or eligible parent filing for the CTC who lists their children as dependents.

- The head of the household with an Adjusted Gross Income (AGI) of up to $112,500 must apply.

For note: If your income is higher than these limits, then your eligibility for partial payments will most likely still apply. If your Adjusted Gross Income (AGI) is above the threshold of $100, then the payment amount will be reduced by $5, and so on. Visit the official IRS website to check more details regarding eligibility for the 4th Stimulus Check payments.

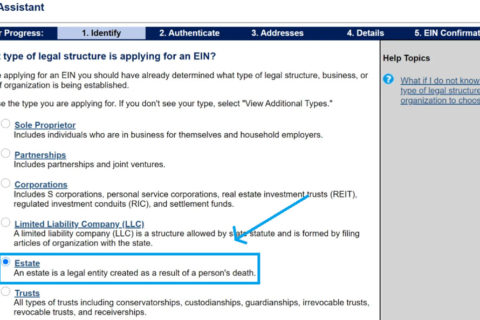

Methods of the 4th Stimulus Check Payment

There are several payment methods in receiving the 4th stimulus check payment.

-

Direct Deposit

Direct deposit is the fastest and most recommended method to receive the $1400 stimulus check payment. Your most recent tax return financial institution account information has been used by the Internal Revenue Service (IRS) to routinely deposit the fee.

-

Paper Check

If the Internal Revenue Service (IRS) cannot find your bank account information or if you select to no longer make direct deposits, then a stimulus check payment will be sent to you. This means that everyone can get stimulus check payment without having a bank account.

-

Economic Impact Payment (EIP) Card

For certain recipients, particularly those whose addresses no longer match or who previously had problems getting mail, the Internal Revenue Service (IRS) allocates a $1400 stimulus check on the Economic Impact Payment (EIP) card.

Checking the 4th Stimulus Check Payment Status – Here’s Guide

To check your payment status for the 4th Stimulus Check, you can follow these steps:

-

- At the first step, go to the official IRS website.

- Once you are on the homepage of the official IRS website, you can log in by using your login credentials.

- Then, you will be taken to your IRS Dashboard.

- The next step, you must enter your Social Security Number (SIN) or tax ID and click the “Submit” button. Make sure you enter your Social Security Number (SIN) or tax ID correctly.

- Please find the link to check the IRS Tax 4th Stimulus Check payment status.

- By following the steps above, you can find out your IRS 4th Stimulus Check payment status.

Stimulus Check Payment is generally sent to the recipient’s account through direct deposit. Certainly, these funds have improved the financial status of US Citizens and reduced their tax burden.

A bookworm and researcher especially related to law and citizenship education. I spend time every day in front of the internet and the campus library.