When considering where to work or live, sometimes taxes play a big part in decision-making. Before making a decision, you may want to find out whether or not a state imposes an income tax. For example, if you want to move to Wyoming for work or live or both, you may want to find out about the state income tax of this state. Fortunately, you are here where you will be guided about the state income tax in Wyoming.

Definition of State Income Tax

State income tax is described as a tax that you might pay based on the money you gain. It is different compared to federal income tax. One of the things that set them apart is that the federal income tax is consistent across the United States while state income tax can vary depending on the state. While these two are different, they share some similarities, including their returns due, which is on April 15th. However, the deadlines may be different in some states. That’s why it is important for you to check the details for where you live.

Deciding Tax Rates

The tax rates in the states in the United States are pushed by budgetary needs. They fund important things such as schools, roads, and public safety. The tax rates in every state should be aligned with their spending goals. It is the reason why they should be reviewed and adjusted regularly.

The tax systems may vary from state to state. Some states apply a flat tax rate to every single resident while some others use progressive rate that goes up as income goes up. Usually, it is affected by the financial strategy and political environment of the state. Aside from that, it can also be influenced by economic factors. Basically, the rates may be lowered to invigorate growth and may be increased during the crisis.

State Income Tax of Wyoming

For anyone who is wondering if Wyoming has a state income tax, the short answer to the question is no. Wyoming has no state income tax.

Reasons Why Wyoming Has to State Income Tax

Are you wondering why Wyoming does not have state income tax? There are a few reasons why this state has no state income tax, as follows:

-

It has low population and high revenue

Wyoming ranks second in the list of the least densely populated states, losing only to Alaska. There are approximately six people per square in this state or only one human being in every square mile. Even though it has a small population, it benefits from the other revenues, making it possible for the residents to be free from personal or corporate state income taxes, retirement income taxes, and only have to pay low sales tax rates.

Many would agree that the economic strategy used by Wyoming is pretty unique. Even though it has no income tax, it is able to maintain healthy finances. In 2021, this state spent $18,144 per student in the state, making it the best quartile of the states in the United States. Besides, in 2015, this state was also awarded a grade of A for its school funding distribution, making it tops the list. In 2020, Wyoming spent $10,989 per capita on healthcare. It was considered strong. When it comes to infrastructure, it is also pretty strong. As per the ASCE data, 6.9% of bridges in this state are structurally deficient and 99 of its dams have a high hazard potential in 2021.

-

It has diverse revenue sources

The main revenues of Wyoming are mineral extraction, especially oil, coal, and natural gas, tourism, and agricultural activities. As reported by the Cowboy State Daily, the taxes of these things make up for the lack of a personal income tax, just like Alaska.

-

It has business friendly-environment

As Wyoming does not have state income tax, it makes it to the list of one of the best destinations for businesses and individuals looking for tax-friendly environments. According to the U.S. News & World Report, it is the 26th best state to live in and 18th in affordability.

Other States without State Income Tax

In fact, Wyoming is not the only state in the United States with no state income tax. Apart from this state, the other states without such a tax include:

-

- Alaska

- New Hampshire

- Tennessee

- Florida

- South Dakota

- Nevada

- Texas

- Washington

Income Tax Rate by State

If you are curious about the income tax in other states, check out the rank below:

|

Rank |

State | Net Pay |

State Tax Rate |

|

1 |

Alaska | $62,340 | 0.00% |

|

1 |

Florida | $62,340 | 0.00% |

|

1 |

Nevada | $62,340 |

0.00% |

| 1 | New Hampshire | $62,340 |

0.00% |

|

1 |

South Dakota | $62,340 |

0.00% |

|

1 |

Tennessee | $62,340 |

0.00% |

|

1 |

Texas | $62,340 | 0.00% |

|

1 |

Washington | $62,340 | 0.00% |

| 1 | Wyoming | $62,340 |

0.00% |

| 10 | North Dakota | $61,569 |

1.10% |

|

11 |

Ohio | $61,090 | 1.79% |

|

12 |

Arizona | $60,746 | 2.28% |

| 13 | Rhode Island | $60,227 |

3.02% |

| 14 | Pennsylvania | $60,191 |

3.07% |

|

15 |

Louisiana | $60,137 | 3.15% |

|

16 |

Indiana | $60,111 |

3.18% |

| 17 | New Jersey | $60,019 |

3.32% |

|

18 |

Colorado | $59,830 | 3.59% |

|

18 |

New Mexico | $59,824 | 3.59% |

|

20 |

Vermont | $59,816 |

3.61% |

| 21 | Connecticut | $59,765 |

3.68% |

| 22 | Wisconsin | $59,599 |

3.92% |

|

23 |

Michigan | $59,577 | 3.95% |

|

24 |

Mississippi | $59,555 |

3.98% |

| 24 | California | $59,552 |

3.98% |

| 24 | Oklahoma | $59,552 |

3.98% |

| 27 | Missouri | $59,502 |

4.05% |

|

28 |

North Carolina | $59,483 | 4.08% |

|

29 |

Maryland | $59,331 | 4.30% |

| 30 | Arkansas | $59,185 |

4.51% |

| 31 | Idaho | $59,149 |

4.56% |

|

32 |

Kansas | $59,135 | 4.58% |

|

33 |

Alabama | $59,105 |

4.62% |

| 34 | South Carolina | $59,096 |

4.63% |

|

35 |

Virginia | $59,086 | 4.65% |

|

36 |

Massachusetts | $59,060 | 4.69% |

| 37 | West Virginia | $59,045 |

4.71% |

| 38 | Washington, D.C. | $59,031 |

4.73% |

|

39 |

Nebraska | $59,017 | 4.75% |

|

39 |

Kentucky | $59,015 | 4.75% |

|

41 |

Maine | $59,008 |

4.76% |

| 42 | Illinois | $58,992 |

4.78% |

| 43 | Utah | $58,982 |

4.80% |

|

44 |

Delaware | $58,958 | 4.83% |

|

45 |

Georgia | $58,953 | 4.84% |

|

46 |

New York | $58,926 |

4.88% |

| 47 | Minnesota | $58,864 |

4.97% |

| 48 | Montana | $58,744 |

5.14% |

|

49 |

Iowa | $58,535 |

5.43% |

|

50 |

Hawaii | $57,587 |

6.79% |

| 51 | Oregon | $56,710 |

8.04% |

Other Taxes in Wyoming

If you are a resident of Wyoming or someone who is planning to move to this state, you may also want to know the other taxes in this state. Check out the details below:

-

Sales tax

Apparently, state sales tax in Wyoming is 4.0%. For your information, the average local sales tax is 1.36%. It means a combined rate is 5.36%. Keep in mind that clothing and motor vehicles are taxable while groceries and prescription drugs are not.

-

Property tax

According to the Tax Foundation, the median property tax rate in Wyoming is 0.56% of assessed home value. Apparently, this state has a property tax deferral program that allows the citizens to make a delayed payment of up to 50% of property taxes owed on a principal residence as long as the land is less than 40 acres. Plus, the homeowner also needs to have limited income to be eligible. Additionally, they have to be more than 62 years old or disabled and have owned the property at least a decade before applying for the tax deferral.

-

Gas tax

There are two products: gas or motor fuel. These are gasoline and diesel. The tax for both of them is the same, which is $0.24 per gallon.

-

Tobacco and alcohol taxes

The tobacco tax in Wyoming varies, depending on the product. For cigarettes, the tax is $0.60 per pack. Just like cigarettes, the tax is also $0.60 for snuff. For other tobacco products, it is 20% of the wholesale price. Similarly, the tax is also 20% of the wholesale price for vapor products.

According to the Sales Tax Handbook, the taxes for alcohol are also different. For beer, it is $0.02 per gallon. For wine, there is no tax or $0.00 per gallon. As for liquor, the tax is state-controlled.

-

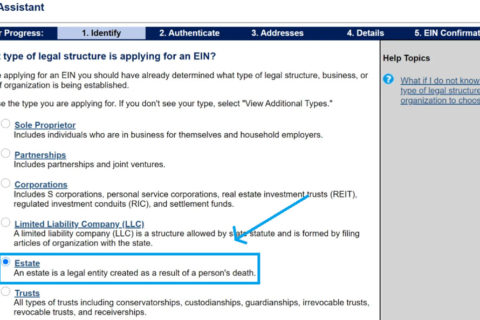

Estate and inheritance taxes

Wyoming does not have estate or inheritance tax.

Bottom Line

In conclusion, Wyoming does not have a personal income tax, just like Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Washington. All of these states give their residents the benefit of keeping more of their earned income. They are the most recommended states for those who are looking to maximize their earnings. However, it should be noted that while it is true that New Hampshire does not have an earned income tax, it does have tax interest and dividend income. In addition, Washington also levies no state income tax but does on investment income and capital gains for certain high earners.

A bookworm and researcher especially related to law and citizenship education. I spend time every day in front of the internet and the campus library.