In addition to being used by employers when filing business tax returns, an EIN can also identify an estate if there’s a valid and active probate. An estate itself, also known as a decedent estate, is defined as a legal entity that is formed due to the death of someone.

So, why do you need to create an EIN for an estate? If it’s really important, how can you get it?

What is an EIN?

Employer Identification Number (EIN) is an identification number which is also called a Federal Tax ID. This unique nine-digit number is issued by the Internal Revenue Service (IRS) to a business entity. An EIN covers details about the state where the business is registered.

The IRS will use EIN to identify any corporations in the United States. Then, they can use it to file various business tax returns.

A corporation is required to have an EIN if they operate as a corporation, have at least one employee, withhold tax on income other than salary, file various tax returns, have a Keogh plan, and get involved in plenty of types of organizations.

If you administer one or more of the following business entities, you must create an EIN:

-

- Limited liability companies (LLCs)

- Sole proprietorships

- Non-profit organizations (NPOs)

- Government agencies

- Partnerships

- S corporations

- Trusts

- Estates

Usually, the IRS will issue an EIN, and you may receive it after two weeks of submission.

What Does an Estate Mean?

An estate will be formed upon the death of a person, and it consists of the wealth and/or personal property of the deceased. It can be used to pay off any debts that the decedent has. If there’s any remainder, it can be distributed to the beneficiaries of the inheritance.

To keep all of the deceased’s property, a bank account for estates may be necessary to open. Before getting started, the personal representative can change the type of structure if it should be performed.

How Does an EIN Estate Work?

An EIN estate is an identification number that is applied by a personal representative on behalf of someone who has died. They will obtain the EIN from the IRS after the letters testamentary or letters of administration have been issued.

The EIN for estate is actually needed to create an estate bank account, either at a local or national bank. Once created, the personal representative of the deceased person can use it to hold funds from the decedent’s estate. If the probate is completed, funds can then be distributed to the decedent’s beneficiaries.

In addition, an EIN estate can also be used to keep funds that come from investments or other assets. If so, the financial institution may issue a Form 1099 to the estate.

How Do You Get an EIN for an Estate?

It’s pretty straightforward to get an EIN. Just applying it and following the instructions, you’ll receive it, maybe in a faster time. The IRS offers three methods for applicants to file their EIN applications.

Either your business is situated within or outside the United States, you can really apply for it easily. Let’s take a look!

For business within the U.S.

There are three methods you can take to apply for an EIN if your corporation or legal residence is situated in the United States or U.S. territories, including:

Method 1: Online

This is a highly recommended method for faster processing time for your application. IRS offers EIN online applications from Monday to Friday, starting from 7 a.m. to 10 p.m., EST.

All details on your application will be validated during the online session. After it is completed, an EIN will be issued immediately. You can then see, print, and store your EIN assignment notice at the end of the session. The IRS will then send it to you by mail.

To apply for an EIN online, the applicants, either the principal officer, owner, general partner, grantor, trustor, etc., should have a valid taxpayer identification number.

Method 2: Mail

If you cannot take the online method, you can send the form SS-4 you’ve filled out to the IRS service center, where you can find the location on the instructions for the form SS-4.

You definitely have to mail it at least 4 to 5 weeks before you’ll really need an EIN since it can be received in 4 weeks after the IRS has finished up your application.

Method 3: By Fax

If you prefer to apply for EIN by fax, you’ll have to know the IRS fax numbers, and you can find them on the instructions for Form SS-4. https://www.irs.gov/pub/irs-pdf/iss4.pdf

Then, you may receive your EIN within 4 business days, and it is available 24/7, so you can apply for it by fax anytime.

For business outside the U.S.

If you’re an international applicant, you can apply for EIN by using the following two methods:

Method 1: By phone

You can make a phone call to the IRS at 267-941-1099, starting at 6 a.m. to 11 p.m., from Monday to Friday. It’d be better for you to complete the form first before contacting the IRS, so you will be ready to answer any questions regarding the form SS-4. However, the IRS will use the information you provided to create your account and issue an EIN to you.

Method 2: By fax

Applying for an EIN by fax for international applications is the same as for applications for those who live in the U.S. So, you can see a single step above.

Okay, those are all of the methods, either for U.S. or international applicants, to apply for an EIN estate.

How Can You Get an EIN for an Estate Faster?

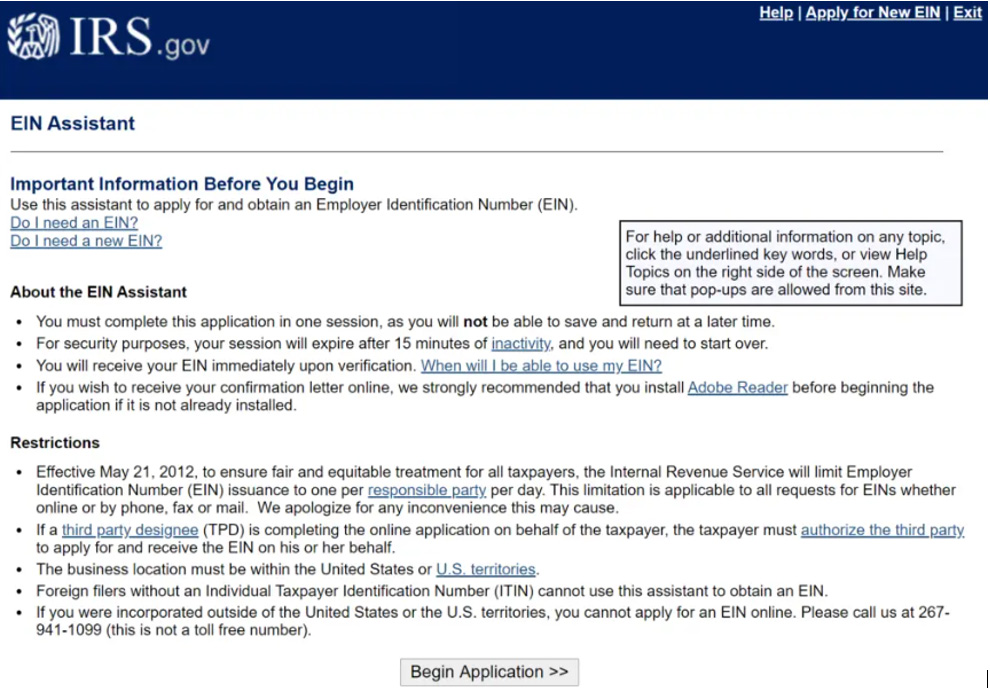

We can say, “Yes,” and you can really obtain an EIN estate as soon as possible. The fastest and easiest method to apply for an EIN is online. And the IRS’s portal for EIN applications is easy to access.

To get started, you can go to the IRS EIN Assistant page, which you can access at https://sa.www4.irs.gov/modiein/individual/index.jsp.

Once you’re at the page, you can click “Begin Application.”

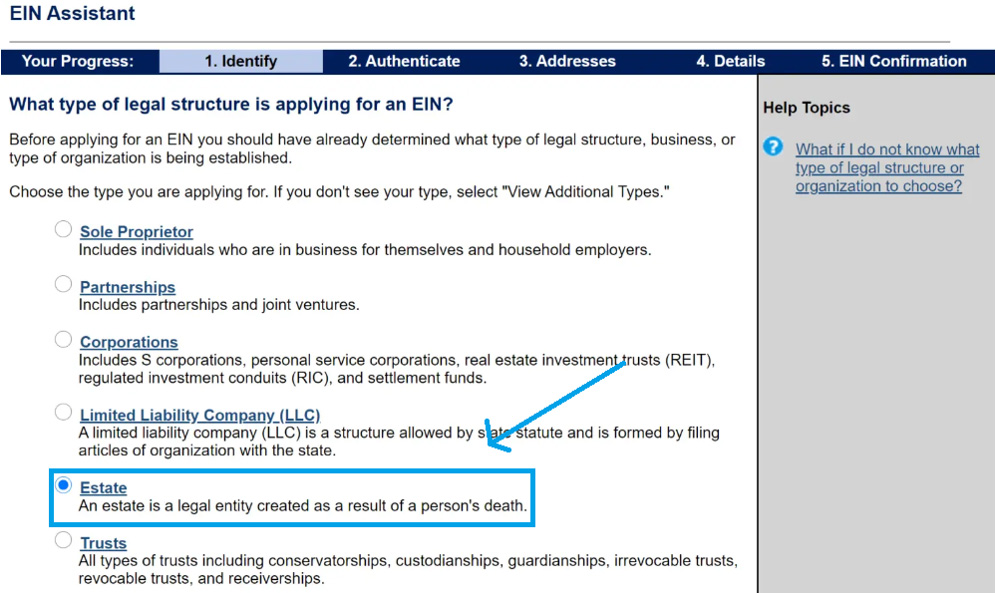

On the next page, you can choose “Estate.” Then, click “Continue.”

A new page will bring up the things regarding the estate and the guides to applying for it. Click “Continue.”

On the “Authenticate” tab, you’ll have to fill out some required fields that allow you to tell us about the deceased person.

You must choose the option if you’re a personal representative, executor, or administrator. And make sure to provide your personal information, which should be matched with IRS records. If not, the portal will not continue to process your application.

Under the address tab, you must completely input the address information since it would be the mailing address for the estate.

On the following page, you must fill out information about the estate, including the name of the state, the address where the estate is probated, and the date when the estate was created. Click “Continue.”

You’ll have to choose “yes” or “no” to answer the question of whether or not you will have employees in the next 12 months.

In the last step, you need to select one of the two options for the EIN number: 1) You want to receive it online, and 2) You want to receive it by mail.

At this point, you’ve successfully submitted your EIN application, and you just wait for your EIN number to be received.

How Long Does It Take to Receive an EIN Number?

Depending on which method you used to apply for an EIN application, it would determine when you’d receive it.

-

- If you applied it online, the EIN number may be received immediately, less than three days.

- If you applied for it by mail, the EIN number may be received four to five weeks after the IRS issues it.

- If you applied for it via fax, the EIN number may be received two weeks after the IRS issues it.

So, it is very important to choose the right method if you want to receive an EIN number quickly.

What Can You Do with Your EIN Estate Number?

Your EIN estate will permanently be associated with you and your business, and it becomes your entity. It cannot be canceled by the IRS.

Your EIN number will always be essential since it will be required in financial reporting. And it will always be associated with your entity, even if you don’t file your tax return. Shortly after your EIN number is issued, yours can be used at a later time when your entity needs it.

If you no longer need it, you can confirm with the IRS, and they will close your associated business account. And you will receive a physical letter via mail that shows your legal name, your EIN number, your business address, and a strong reason why you want to close your account.

Note: Your EIN number will still exist, but only the entity associated with it will be suspended.

A bookworm and researcher especially related to law and citizenship education. I spend time every day in front of the internet and the campus library.