Thanks to the U.S. Social Security Administration (SSA) programs, an individual who has a disability that limits their ability to work can improve their quality of life economically.

Through the Supplemental Security Income (SSI) program, people with disabilities, regardless of age, qualify for basic financial assistance from the U.S. federal government.

If other SSA social programs may require legal assistance due to complex requirements, what about SSI? Okay, let’s learn about it below!

Read also: What Does a SSDI Lawyer Do?

How Does the SSI Program Work?

The Supplemental Security Income (SSI) basically helps the elderly and people with disabilities who have very limited ability or even no ability to earn income. This program provides assistance in the form of minimum basic finances that will be paid per month.

SSI benefits from the SSA program are often complemented by state programs. However, this program has proven its capabilities in the United States since it is administratively mandated for those who have income and resources below the threshold due to physical and mental incapacity.

Who Qualifies for SSI Benefits?

Every individual who has a disability and has limited income and resources is eligible for SSI. The following are the main criteria for anyone who qualifies to receive SSI benefits:

-

- Aged (age 65 or older).

- Disabled adults and children who have little or no income.

- Disabled adults and children who have little or no resources.

And several supporting criteria include:

-

- A U.S. citizen or a non-citizen who meets the classification granted by the Department of Homeland Security (DHS).

- A resident of one of the U.S. states, the District of Columbia, or the Northen Mariana Islands, and is not absent for a full calendar month or for 30 consecutive days or more.

- Anyone who is not confined to institutions funded by the government.

- Anyone who files for any other cash benefits or payments that may be his right, such as Social Security benefits and pensions.

- Anyone who files an application.

- Anyone who meets certain requirements.

- Anyone who gives SSA permission to request any financial records to financial institution.

The term “limited income” refers to any earnings, including money a person earns from work; money a person receives from other sources, such as Social Security benefits, unemployment benefits, etc.; and free food or shelter.

While the term “limited resources” means anything a person owns, including cash, bank accounts, land, vehicles, personal property, stocks and mutual funds, life insurance, and anything else that the person has that can be converted to cash.

How Much Will You Get from SSI?

If you’re eligible to get SSI benefits, you’ll receive monthly payments. As of 2024, the maximum payment is about $943 for an individual and $1,415 for a couple.

But the amount of money you’ll receive may be lower since it depends on your income, the things you own, your living situation, and other factors.

Well, there are a few factors that can affect your payment, including:

-

Your earnings

For every $2 you get from your work, the SSA will reduce your SSI payment by roughly $1. The work here includes a job, self-employment, and any activity that earns money.

For every $1 you earn from non-work sources, the SSA will reduce your SSI payment by approximately $1. The non-work sources here include another disability benefit, unemployment payments, and pensions.

-

Your living situation

Keep in mind that your SSI payment will be reduced by up to $334.33 if you live in someone else’s home but don’t pay expenses for food and shelter.

If you live with a spouse and he or she earns money, their income can also affect your payment.

Children who receive SSI benefits and live with their parents may also get reduced payments based on their income or their parents’ income.

-

Extra support from your state

In an effort to help people with food and shelter costs, some states usually offer an extra payment, which is called a “state supplement.” However, this type of payment will not lower your SSI benefit.

To note:

In order to continually receive an accurate payment, you definitely need to report your wages monthly. You must also submit changes to any other income you earn and changes in living situations.

Your marital status, changes in resources, and living arrangements (including entering or leaving a medical or detention facility) will actually affect your eligibility and monthly SSI payments.

How Do You Apply for SSI?

It’s pretty straightforward to apply for SSI, as long as you complete the application correctly. After you’re sure that you’re qualified to receive SSI benefits, you may need to prepare any necessary documents.

Well, the SSA will ask you to provide the following information:

-

- Your personal basic information: Your birthplace and SSN.

- Your recent work: The employers’ names for the past two years and dates of employment.

- Your current and past marriages: Your spouse, your marriage date, and your location (city, state, country)

- Name of your eligible children: They are under 18 or 19 and in high school, or they are disabled before 22.

Aside from your personal information, you also provide any necessary documents to support your application. Here they are:

Documents that show your current income, such as:

-

- Retirement funds

- Dividends and stocks

- Unemployment records, pay stubs and bonuses, and self-employment tax returns

- Insurance payouts

- Child support

- Alimony

- Gambling winnings

- Workers’ compensation records

- State disability payments

Documents that show your other financial resources, such as:

-

- Bank account statements

- Burial contracts

- Car title and loan statements

- Trust fund statements

- Life insurance policy

- Cash surrender value

- Dividend/stock/bond value

Information about your home, such as

-

- The landlord’s name and phone number

- Name and birthday for every individual who lives with you

- Admission agreement

- Rental contract

- Acceptance or discharge letter from the hospital or agency

Once you have prepared for all of the above, you can start to apply for SSI by choosing one of the following methods:

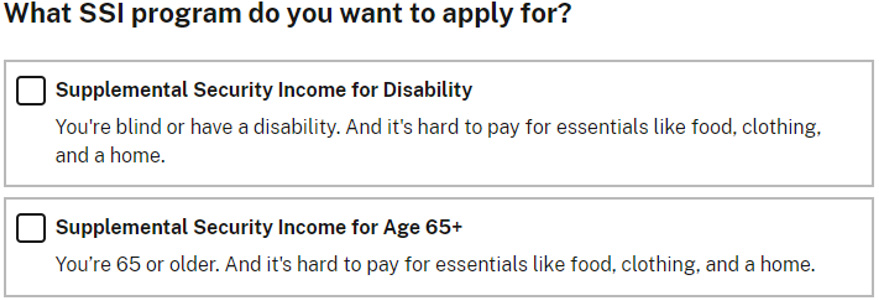

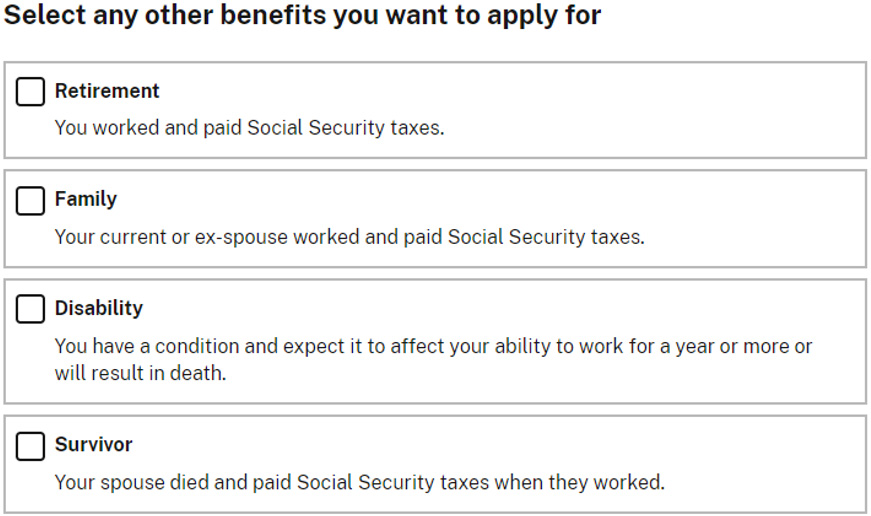

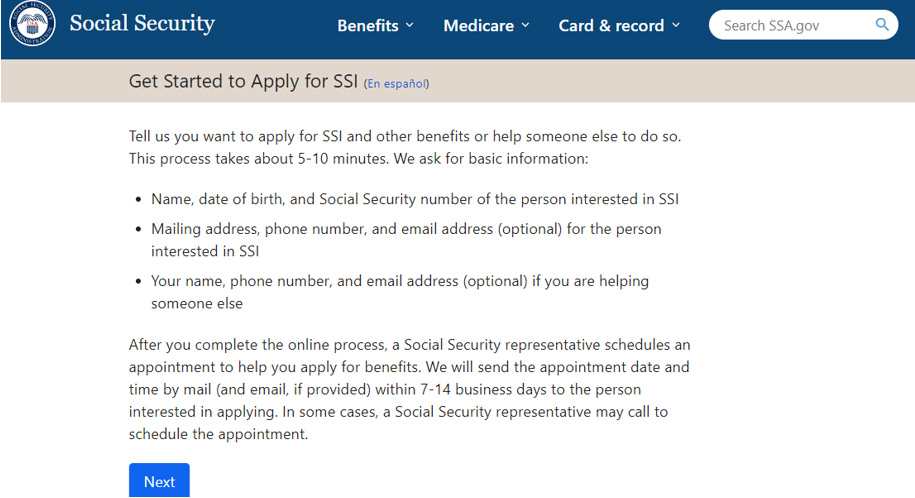

Method 1: Apply online

To apply online, you can access the SSA application page here. https://www.ssa.gov/apply/ssi

After that, you need to select the available options.

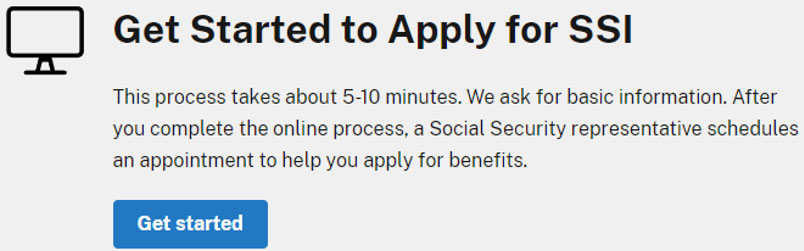

Then, click “Get Started.”

On the following page, you can click “Next.”

And make sure to follow the on-screen instructions until your online SSI application is successfully submitted.

Method 2: Set up an appointment

You can make a phone call to set up an appointment with SSA representatives. This method is available in most U.S. time zones, from Monday to Friday, from 8 a.m. to 7 p.m.

You can call them at +1 800-772-1213 and tell them that you want to make an appointment to apply for SSI benefits. They will usually schedule it and determine whether your application will be performed via phone or in person.

For deaf people or anyone who has hearing problems, they can call an SSA representative at +1 800-325-0778.

Once your application is submitted, SSA will send you a letter to inform you that you’re approved for Supplemental Security Income. Then, you can check your application status to see where yours is.

Do You Need a Lawyer to Apply for SSI Benefits?

When it comes to whether or not you need a lawyer to apply for SSI benefits, it can depend on your personal decision and your situation.

Actually, hiring a lawyer who can help you during the process of filing SSI is not required. But with legal assistance, it can increase your chance of getting Supplemental Security Income (SSI) benefits.

Even though you shouldn’t have a lawyer or a disability advocate, they can represent you in your dealings with the Social Security Administration (SSA). Oftentimes, the SSA rules and procedures are quite complicated. If you don’t know what to do, your achievements may be hampered.

Of course, a lawyer can fill out the SSI application on your behalf. They will also help collect medical records and other evidence for your claim.

Afterwards, the SSA will work directly with your representative and provide access to information from your Social Security file.

When you have a representative during the SSI benefits application process, they will file an appeal if you disagree with Social Security’s initial decision on your claim.

What Can a Lawyer Do During Your SSI Application Process?

Basically, a lawyer can help you with your disability benefits application. But everyone’s case will determine how fast or slow the process is and whether the application is successful or not.

If you hire a social security disability lawyer, they will:

-

- Perform an initial review of your claim.

- Make sure you’ve completed your application.

- Document your work history accurately and completely.

- Collect additional medical proof.

- Describe the relevant laws that apply to your case.

- Ensure you meet all of the requirements.

- Provide information in the best manner possible to support your claim for benefits.

- Represent you during the process of your SSI application.

Importantly, getting a lawyer who can really handle your SSI claim can relieve some of your worries and stress since doing it will take up extra energy and time, right? So, think carefully!

A bookworm and researcher especially related to law and citizenship education. I spend time every day in front of the internet and the campus library.