If you are having trouble getting your application for Social Security Disability benefits approved, what you should do is contact a disability lawyer to help you get your claim approved. Now you may be wondering about how much it costs to hire a SSDI lawyer. You should know that the law limits the fees that can be earned by a lawyer representing a client in a Social Security Disability case. By the way, what is the most a SSDI lawyer can charge? Find the answer in the text below.

Social Security Disability Fee Agreement and Fee Petition

Disability lawyers represent their clients on a “contingency fee” basis. What is a contingency fee? A contingency fee means that the lawyers are not paid their legal fees unless they have won their client’s cases. So, a disability lawyer will only receive legal fees if the client’s case has been accepted and Social Security Disability benefits have been awarded. When accepting client representation, a disability lawyer and the client must sign a written fee agreement. The lawyer needs to send the fee agreement to the Social Security Administration (SSA) for approval. If the Social Security Administration (SSA) approves the agreement, then the Social Security Administration (SSA) will pay the lawyer’s fees from the benefits awarded in your SSD case. Sometimes, the process does not go smoothly, where back pay or overdue benefits are not awarded in a disability claim. For these cases, a lawyer needs to file a fee petition with the SSA to request that the agency authorize the lawyer to receive a reasonable fee for the services they have provided to their client.

Contents of a Disability Lawyer Fee Agreement

A disability attorney fee agreement contains various provisions that govern the relationship between the lawyer and the client, such as the scope of the lawyer’s representation, the lawyer’s response time, assurances regarding the frequency of communication, and what tasks the client is expected to perform in the case.

The Social Security Administration has two main requirements for fee agreements covering SSD claims:

-

- The agreement must not charge the client fees that exceed established Social Security regulatory limits.

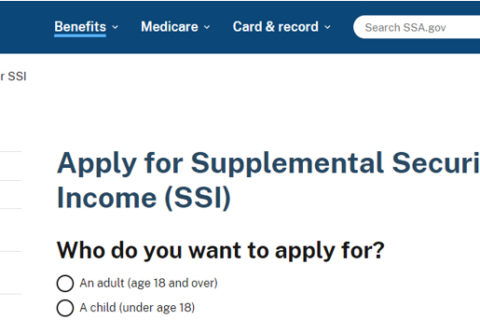

- The lawyer and the client who wants to claim Social Security benefits must sign the agreement. If the claimant is a child, the parent can sign the agreement on behalf of the child claimant. If the claimant is an adult individual, the guardian or attorney can sign the agreement on behalf of the adult claimant.

How is SSDI Lawyer Fee Calculated and Paid?

Disability lawyer fees are calculated based on the backpay you receive when your SSD case is won. This back pay typically includes the amount of disability benefits you would have received had your claim been accepted at an earlier stage or any other back pay amount the SSA requires. When the Social Security Administration approves your lawyer fee agreement, it will pay your lawyer directly, deduct it from your award repayment, and then send you the award balance.

In addition to attorney’s legal fees, the Social Security Administration also allows disability lawyers to charge expenses incurred in the course of handling your case. These costs involve processing fees, administrative fees for obtaining medical records, or postage fees. Your lawyer will probably not ask for an advance payment for handling your case. However, some lawyers may ask you for a small down payment at the start of your case. The down payment is kept in a trust account. Meanwhile, there are also some other lawyers who will only ask you to reimburse the costs incurred by the lawyer at the end of your case.

What is the Maximum Lawyer Fee for SSDI?

Disability lawyers are paid on a contingency basis, or only if your claim is won or approved. Disability lawyer fees are paid with a portion of the client’s past-due benefits, known as back pay. Past due benefits are benefits payable to a person during the months between the onset of disability and the start of disability coverage. By the way, what is the most fees a SSDI lawyer can charge? You should know that the government has capped the amount of fees that a disability lawyer can charge his client. Under Social Security regulations, a disability lawyer’s legal fees are capped at 25% of the total amount of back pay obtained in the client’s case, or $7200, whichever is lower. When your claim for benefits is accepted, the SSA immediately deducts the lawyer’s fees from your benefits and sends them directly to your lawyer.

For example, if you are awarded a back pay of $10,000, then your lawyer will receive 25% of the $10,000 in legal fees which is $2,500. Then, if you are awarded a back pay of $40,000, your lawyer may receive 25% of the $40,000 in legal fees which is $10000. Another example, if you are awarded past-due benefits of $21,000, then your lawyer will receive up to 25% of the amount, which is $5,250. The government will directly deduct $5,250 from your benefits to pay the lawyer, so you will receive the remaining $15,750. Then, what if your past due benefits are $38,000, will your lawyer accept 25% of your past due benefits, which is $9,500. The answer is no. Your lawyer will only receive $7,200, according to the maximum limit set by Social Security regulations.

When Can SSDI Lawyers Charge Higher Fees?

As we have already explained, SSDI lawyers can only receive 25% or a maximum of $7200 of the benefits received by the client. However, it turns out that there are some situations where SSDI lawyers can charge higher fees to their clients. A disability lawyer has the right to charge fees in excess of the fee limits set by Social Security if a denial of disability benefits is filed in federal court. However, before being entitled to charge higher fees for continuing litigation in court, a disability attorney must obtain further approval from the Social Security Administration. If the Social Security Administration does not give approval, then the disability lawyer is not entitled to charge higher fees.

Another situation where disability lawyers can charge higher fees to their clients is when they replace a previous lawyer who has been discharged by the client. If the previous lawyer does not waive the fee (agree not to charge the fee) when the new lawyer is hired, then the new lawyer must petition Social Security for the fee to be split between the two lawyers, the discharged lawyer and the new lawyer. In some cases, the SSA may award legal fees to both attorneys that are higher than $7,200, which exceeds the statutory legal fee limit.

A bookworm and researcher especially related to law and citizenship education. I spend time every day in front of the internet and the campus library.